TLDR

Tuna launch pad presents bonding contour and 60-minute departure defense for very early purchasers.

Early individuals in Tuna launch pad can leave without loss throughout the very first 60 mins.

The system intends to avoid quick discarding and carpet draws generally seen in memecoins.

Tuna’s bonding contour makes sure a much more organized cost exploration for freshly introduced symbols.

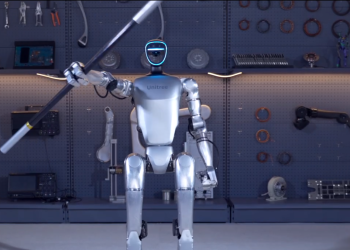

The Tuna Launch Pad, a Solana-based system, has actually presented a brand-new function targeted at fixing a persisting concern in the memecoin market: quick post-launch dumps. In a market typically slammed for its volatility, Tuna has actually introduced a bonding contour system with integrated departure defense. This system is created to supply very early purchasers with defense throughout the critical very first hour of a token’s launch.

Under this brand-new version, a 60-minute lockup duration is applied after the token’s production. Throughout this time around, very early purchasers are not able to leave their settings muddle-headed, providing a possibility to assess market problems prior to choosing. The departure defense warranties that these individuals can recover their primary financial investment throughout this duration, without experiencing a loss, besides the linked gas charges.

Exactly How the Bonding Contour and Departure Defense Feature

The Tuna Launch pad’s bonding contour presents a much more organized technique to cost exploration. Unlike standard free-for-all swimming pools, the bonding contour raises the cost of symbols as need expands. Very early purchasers acquisition symbols at considerably greater costs, which urges them to hold their settings and withstand the lure to market too soon.

Throughout the very first 60 mins, purchasers are limited from marketing their symbols. Nonetheless, if they select to leave, they can do so with zero-loss defense, guaranteeing they obtain back their preliminary financial investment, omitting gas charges. This style assists to avoid the sort of panic marketing that generally adheres to a memecoin launch. It likewise lowers the danger of experts discarding their symbols on brand-new individuals, which has actually been a considerable trouble in the past.

As soon as the 60-minute defense duration ends, the token goes into the free market for unlimited trading. At this moment, the typical cost volatility returns, and vendors can liquidate their settings at market value. This two-phase technique intends to strike an equilibrium in between restricting instant volatility and permitting cost exploration to happen normally.

Tuna Launch pad’s Duty in Solana’s Memecoin Environment

The intro of the Tuna Launch pad’s bonding contour with departure defense comes with a time when Solana is experiencing substantial development in the memecoin industry. Solana’s high-speed blockchain and reduced deal charges have actually made it an appealing system for meme coin tasks. Nonetheless, this very same rate has actually likewise brought about quick cost changes and the sensation of “carpet draws,” where very early financiers are entrusted little choice after the cost collisions.

Tuna’s version tries to reduce this procedure down by presenting a 60-minute lockup that dissuades very early sell-offs. Because of this, Tuna intends to produce a much more steady atmosphere for memecoin launches on Solana. This brand-new launch pad is different from the $TUNA DeFi framework procedure, which operates Solana however concentrates on liquidity swimming pools and decentralized financing attributes.

Tuna vs. DefiTuna: A Clear Difference

It is very important to keep in mind that the Tuna Launch pad is not the very same item as the DefiTuna procedure. While both share the “Tuna” brand name, both items offer various functions. The Tuna Launch pad concentrates on helping with the launch of brand-new symbols, specifically in the memecoin area, with systems like bonding contours and departure defense. On the various other hand, DefiTuna runs as a DeFi framework procedure offering attributes such as focused liquidity and loaning.

The $TUNA token related to the DeFi system is currently trading on exchanges, with a market capitalization of around $11.5 million since December 2025. For that reason, any kind of complication in between both must be stayed clear of as the usage instances, groups, and functions vary.