Technical elements controlled as FIL preserved a limited relationship with more comprehensive crypto belief while developing assistance over $1.27. Upgraded Dec 24, 2025, 4:16 p.m. Released Dec 24, 2025, 3:36 p.m.

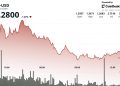

Filecoin FIL $1.2791 slid 2% to $1.28 on Wednesday, tracking more comprehensive crypto market moves as opposed to reacting to token-specific stimulants.

The token’s rate activity continues to be very closely linked to the crypto market belief, according to CoinDesk Research study’s technological evaluation design. This limited relationship suggests big order circulations are driving the rate steps as opposed to basics for Filecoin, according to the design.

The more comprehensive crypto market scale, the CoinDesk 20 index, was 0.6% reduced at the time of magazine.

Trading quantities for Filecoin enhance the combination style, with 24-hour task 7.3% over once a week standards signifying gauged engagement, the design claimed.

The design likewise revealed that quantity patterns sustain range-bound trading as engagement disappoints outbreak limits. The gauged uptick recommends buildup as opposed to hostile placing that generally comes before significant directional steps.

Technical Evaluation: Key assistance holds at $1.27, while resistance remains company at $1.35 from volume-driven heights. 24-hour task 7% over the once a week standard reveals stable engagement by big owners, with an 85% quantity rise throughout $1.35 examination, verifying vital resistance. The development of greater lows, from $1.266 to $1.276, within a $0.087 array, suggests a build-up stage. The prompt upside target beings in the $1.285-$ 1.290 area, based upon array expansion, with more comprehensive resistance at $1.35 needing a quantity rise to be breached. Please note: Components of this post were produced with the aid from AI devices and assessed by our content group to guarantee precision and adherence to our criteria. To find out more, see CoinDesk’s complete AI Plan.

Much more For You

State of the Blockchain 2025

L1 symbols extensively underperformed in 2025 regardless of a background of governing and institutional success. Discover the vital fads specifying 10 significant blockchains listed below.

What to understand:

2025 was specified by a plain aberration: architectural development rammed stationary rate activity. Institutional turning points were gotten to and TVL raised throughout a lot of significant ecological communities, yet most of large-cap Layer-1 symbols ended up the year with unfavorable or level returns.

This record examines the architectural decoupling in between network use and token efficiency. We check out 10 significant blockchain ecological communities, discovering procedure versus application incomes, vital environment stories, technicians driving institutional fostering, and the fads to view as we head right into 2026.

Sight Complete Record

Much more For You

Bitcoin quickly trades at $24,000 on Binance’s USD1 set in flash relocation

Such abrupt rate modifications are commonly because of slim liquidity and can be aggravated by less energetic investors throughout quieter hours.

What to understand:

Bitcoin briefly went down to $24,111 on Binance’s BTC/USD1 set previously rapidly recoiling over $87,000. The rate variation was separated to a stablecoin set backed by Globe Freedom Financial and did not influence various other significant BTC sets. Such abrupt rate modifications are commonly because of slim liquidity and can be aggravated by less energetic investors throughout quieter hours. Review complete tale