The decrease was gone along with by sharp volatility in bitcoin and weak point in united state technology supplies, recommending a return of risk-off view. Dec 17, 2025, 5:20 p.m.

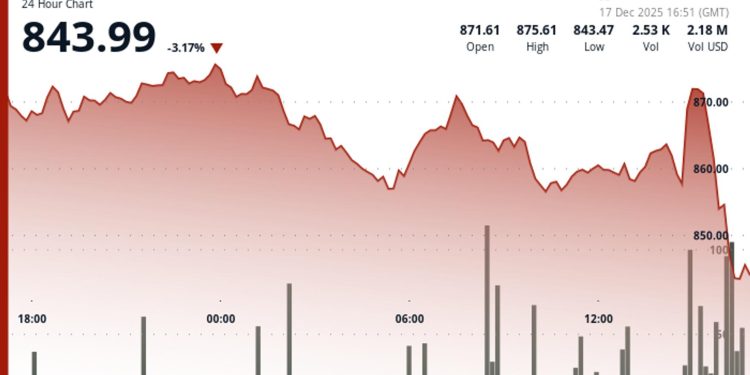

BNB glided virtually 3% over the previous 1 day, being up to around $844 as a sharp turnaround in bitcoin and restored weak point in united state technology supplies splashed with crypto markets.

The token mins previously had actually climbed to $872, however fell short to hold gains prior to marketing stress sped up, according to CoinDesk Research study’s technological evaluation information design.

The step noted a change from current debt consolidation. After numerous sessions of protecting the $855–$ 857 location, BNB damaged listed below that assistance throughout united state trading hours. Rates quickly jumped towards $860, however vendors swiftly restored control, pressing the token to session lows near $843.

The decrease unravelled together with hefty volatility in bitcoin, which quickly rose over $90,000 prior to toppling back listed below $86,600. Losses in fabricated intelligence-linked supplies such as Nvidia and Broadcom dragged the Nasdaq reduced, strengthening risk-off view throughout danger properties.

Quantity on BNB rose throughout the failure, with numerous huge spikes looking like rates slid with assistance. The pattern recommends forced marketing or stop-loss causes as opposed to the organized pullbacks seen previously in the week.

On temporary graphes, BNB’s framework weakened as the break listed below $855 finished the previous debt consolidation variety. That degree currently serves as near-term resistance.

Holding over $840 will certainly be crucial to stay clear of a much deeper approach $830. A healing back over $855 would certainly be required to support the pattern and resume a course towards $870.

BNB’s slide mirrors the wider tone in crypto markets, where reducing liquidity has actually magnified cost swings. For investors, the most recent step highlights just how swiftly problems can change when macro stress rams slim year-end trading.

Please note: Components of this write-up were produced with the help from AI devices and assessed by our content group to make certain precision and adherence to our requirements. For additional information, see CoinDesk’s complete AI Plan.

A lot more For You

Procedure Study: GoPlus Safety

What to understand:

Since October 2025, GoPlus has actually produced $4.7 M in overall profits throughout its product. The GoPlus Application is the main profits motorist, adding $2.5 M (approx. 53%), complied with by the SafeToken Procedure at $1.7 M. GoPlus Knowledge’s Symbol Protection API balanced 717 million regular monthly phone calls year-to-date in 2025, with an optimal of virtually 1 billion contact February 2025. Complete blockchain-level demands, consisting of purchase simulations, balanced an extra 350 million each month. Considering that its January 2025 launch, the $GPS token has actually signed up over $5B in overall place quantity and $10B in by-products quantity in 2025. Regular monthly place quantity came to a head in March 2025 at over $1.1 B, while by-products quantity came to a head the very same month at over $4B. Sight Complete Record

A lot more For You

Investors weigh all-time low as bitcoin go back to week’s lows listed below $86,000.

One expert isn’t rather all set to call a base, however claims bitcoin is certainly in an oversold problem.

What to understand:.

Bitcoin’s very early rally Wednesday appears a pale memory as the cost has actually gone back to the week’s lows. Rare-earth elements remain to obtain quote, with silver hurrying to yet an additional brand-new document and gold closing know an all-time high. One expert warned versus checking out way too much right into the present bitcoin cost activity as a result of year-end positioning and tax obligation factors to consider. Check out complete tale.