Dogecoin’s price has recently demonstrated a noteworthy shift, as technical indicators signal a potential reversal in its market trend. Analysts point to the Relative Strength Index (RSI) divergence as a key factor confirming this change, suggesting renewed momentum for the popular cryptocurrency. This development has captured the attention of traders and investors alike, prompting closer scrutiny of Dogecoin’s next moves in a volatile market environment.

Dogecoin Price Reversal Validated by Key RSI Divergence Signal

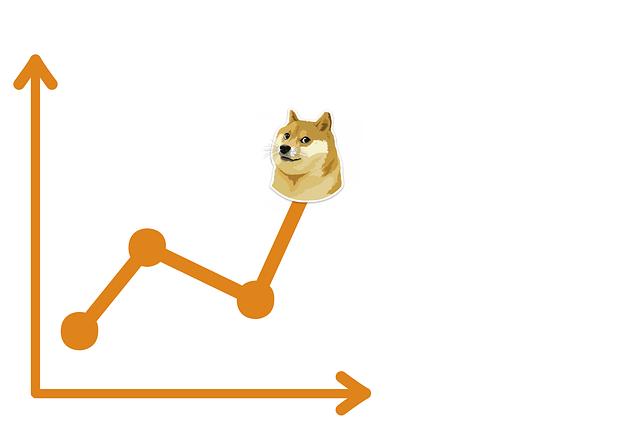

Recent market activity has highlighted a crucial Relative Strength Index (RSI) divergence that signals a potential turning point for Dogecoin’s price trajectory. This divergence occurs when the price charts display new lows, while the RSI fails to replicate those lows, suggesting waning selling momentum. In this case, the bullish divergence points to the likelihood of a reversal from the previous downtrend, as traders and analysts spot an opportunity for a rebound before significant price appreciation takes place.

Key factors reinforcing this reversal outlook include:

- RSI Level Change: The RSI recently climbed above the oversold threshold, signaling improved buying interest.

- Volume Confirmation: Trading volumes have shown a subtle uptick, supporting the strength behind the price move.

- Price Action: Formation of higher lows has been spotted on Dogecoin’s daily chart, matching the RSI divergence.

| Indicator | Current Status | Implication |

|---|---|---|

| RSI (14) | 38 ↑ | Exiting Oversold Zone |

| Trading Volume | Moderate Increase | Supports Price Strength |

| Price Trend | Higher Lows Forming | Signals Potential Uptrend |

Technical Analysis Explores Implications of RSI Patterns on Dogecoin Momentum

The recent RSI divergence observed on Dogecoin’s chart signals a critical turning point in momentum. While the price continued its downward trajectory, the Relative Strength Index (RSI) depicted a bullish divergence, indicating weakening selling pressure. This classic indicator strongly suggests that the downward trend may be losing steam, providing an early warning of a potential reversal. Traders analyzing these patterns typically view such divergences as a signal to start positioning for an upward move, confident that momentum is shifting in favor of buyers.

Key RSI Divergence Insights:

- Price made a lower low, but RSI formed a higher low, proving momentum loss in the bearish phase.

- Increased trading volume confirmed during the formation of the divergence, reinforcing reliability.

- Short-term oversold conditions are being alleviated, opening room for upward price movement.

| Aspect | Observation |

|---|---|

| RSI Value | From 28 to 38 (Bullish shift) |

| Price Action | Lower lows observed |

| Volume | Rising trend |

| Momentum Forecast | Potential bullish reversal |

Market Sentiment Shifts as Dogecoin Eyes Potential Uptrend Confirmation

Throughout the last week, Dogecoin’s market sentiment has undergone a marked shift, catalyzed by a pivotal RSI divergence signaling a potential price reversal. Traders have responded increasingly bullishly, as the Relative Strength Index (RSI) now points toward a sustainable uptrend rather than the previous downbeat momentum. This technical indicator divergence has sparked heightened interest from both retail investors and market analysts who view it as a reliable precursor to upward price movement, especially when coupled with rising trading volumes and improved overall market conditions.

Key factors driving this sentiment change include:

- Increased buying pressure sustained over the past three sessions.

- Strengthening support levels forming around critical price zones.

- Positive shifts in broader crypto market correlations aiding Dogecoin’s recovery.

The below table illustrates Dogecoin’s recent RSI values against key price milestones to highlight the divergence pattern:

| Date | Closing Price (USD) | RSI |

|---|---|---|

| April 18 | $0.075 | 40.2 |

| April 19 | $0.072 | 38.6 |

| April 20 | $0.074 | 45.1 |

| April 21 | $0.078 | 50.7 |

Such data validates the emerging consensus that Dogecoin is positioning itself to overcome recent volatility challenges and potentially embark on a new upward trajectory. Market participants are advised to monitor key resistance levels closely while observing confirmation signals like increasing RSI and volume confluence to capitalize on this momentum shift.

Strategic Recommendations for Traders Navigating Dogecoin’s Emerging Trend

Traders should prioritize monitoring momentum indicators like RSI closely, as the recent divergence signals a potential shift in Dogecoin’s price trajectory. Capitalizing on this momentum requires setting clear entry points aligned with confirmation from volume trends and moving averages to validate the reversal. Moreover, employing tight stop-loss orders is crucial to mitigate downside risk amid volatile conditions, especially near resistance zones where price action may face renewed selling pressure.

Risk management must be paired with a strategic approach focusing on scalability and timing. Consider these core principles to navigate Dogecoin’s evolving market dynamics effectively:

- Use layered entry strategies to average into positions rather than an all-in approach.

- Track correlating altcoins and Bitcoin trends to anticipate broader market shifts influencing Dogecoin.

- Keep an eye on social sentiment and news catalysts as they still heavily impact Dogecoin’s rapid price movements.

| Strategic Element | Recommended Action | Priority Level |

|---|---|---|

| RSI Confirmation | Wait for divergence confirmation before entering | High |

| Volume Trends | Evaluate accompanying volume spikes or contractions | Medium |

| Stop-Loss Placement | Set tight, adaptive stops near critical support levels | High |

Final Thoughts

In summary, the recent RSI divergence has provided a clear technical signal confirming a potential reversal in Dogecoin’s price trajectory. Market participants should monitor subsequent price action closely, as this development may signal a shift in investor sentiment and open new opportunities for traders. As always, prudent risk management remains essential in navigating the inherent volatility of the cryptocurrency market.