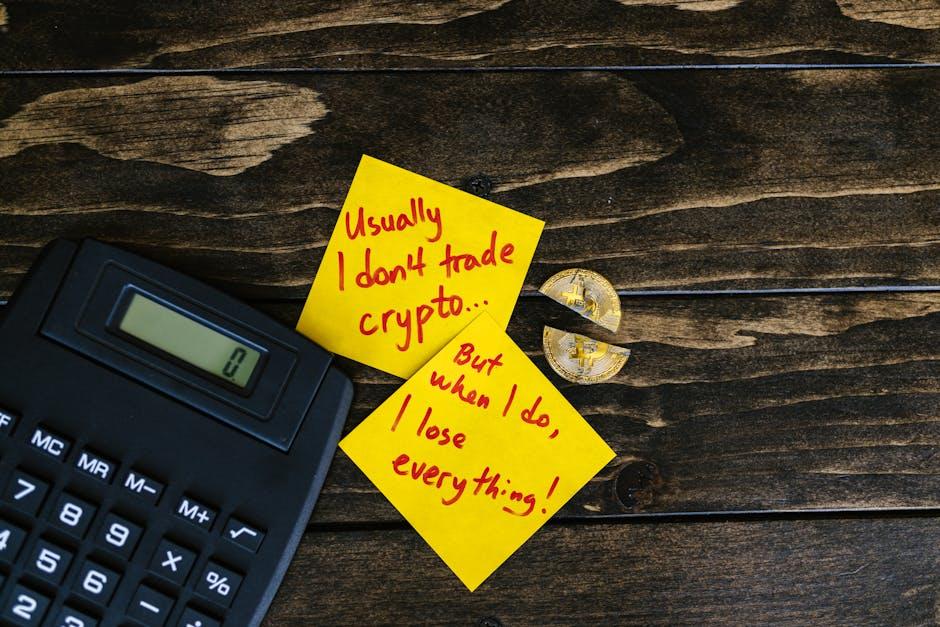

In the fast-evolving world of cryptocurrencies, Solana (SOL) has captured significant attention with its promise of high-speed transactions and low fees. However, recent market dynamics suggest that this rising star may be facing turbulent skies ahead. After losing a critical support level known as KEY, analysts are now warning of a potential 30% plunge for SOL. What factors are contributing to this looming risk, and what could this mean for investors betting on Solana’s future? This article dives into the technical signals and market sentiments that underline the cautious outlook for SOL, offering a balanced perspective on what lies ahead for the once buoyant token.

Solana’s Technical Breakdown Signals Troubling Downtrend

Solana’s price action reveals a weakening momentum that could trigger a significant downturn if immediate support levels fail to hold. The recent breach of the key psychological support around $22.50 has set off alarm bells among traders, pointing to a potential decline approaching 30%. This critical level had previously acted as a magnet for buyers, and its loss suggests increased selling pressure may dominate in the near term. Coupled with declining trading volumes and rising volatility, the technical outlook for SOL is looking increasingly fragile.

- Moving Averages: SOL is trading below its 50-day and 200-day moving averages, a classic bearish signal.

- Relative Strength Index (RSI): Currently hovering near oversold territory, indicating sellers are in control but also hinting at possible short-term exhaustion.

- Volume Patterns: Decreasing volume on upward moves and spikes during sell-offs suggest commitment from bears.

Adding to the bearish sentiment, the MACD indicator has crossed below the signal line, strengthening the argument for a deeper correction. Traders will want to keep an eye on upcoming support zones, particularly the $16-$18 range, which could halt the slide if buying interest rebounds. However, failure to stabilize here may pave the way for a more extended downside phase, risking further losses.

| Indicator | Current Status | Implication |

|---|---|---|

| 50-day MA | Below price | Bearish momentum |

| RSI | Near 35 | Oversold, caution needed |

| MACD | Bearish crossover | Potential for decline |

Understanding Key Support Levels and Their Impact on SOL

When SOL breaks below critical support levels, it signals a shift in market sentiment that often triggers accelerated selling pressure. These key support zones act as psychological barriers where buyers traditionally step in to halt declines. Losing these thresholds can transform cautious optimism into bearish conviction, compelling traders to reconsider their positions. In Solana’s case, the erosion of these support points uncovers vulnerabilities in its price structure, increasing the probability of a sharper pullback as stop-loss orders cascade and confidence wanes.

Understanding the significance of these support levels requires looking beyond just price metrics. They are frequently accompanied by heightened trading volume, indicating strong institutional interest and liquidity pools. Below is a snapshot of notable support ranges for SOL and their associated market dynamics:

| Support Level | Price Range (USD) | Market Sentiment | Volume Impact |

|---|---|---|---|

| Primary | $20.00 – $22.50 | Buyer accumulation zone | High buy volume, strong defense |

| Secondary | $18.00 – $20.00 | Cautious market, potential rebound | Moderate volume, mixed signals |

| Tertiary | $15.00 – $18.00 | Bearish pressure intensifies | High sell volume, stop-loss triggers |

- Primary support represents the last line of defense — losing it often leads to rapid price declines.

- Secondary support provides a buffer zone but lack of recovery here hardens bearish outlooks.

- Tertiary support is a critical fallback but signals desperation from bulls if tested.

Market Sentiment Shifts and Potential Catalysts for Decline

Investor confidence around Solana has taken a noticeable hit following recent market tremors, signaling a departure from the previous bullish momentum. The shift in sentiment is largely fueled by a combination of deteriorating technical setups and broader concerns about blockchain scalability. Traders have started to reposition, increasingly wary of SOL’s ability to hold key levels amid rising pressure from competing layer-1 blockchains. What once was a fortress of support now shows cracks, making panic selling and increased volatility distinct possibilities.

Several potential catalysts could accelerate SOL’s downward trajectory:

- Regulatory developments: Heightened scrutiny on crypto networks could hinder adoption.

- Network outages: Recurring technical issues might dampen user trust.

- Macro-economic instability: Rising interest rates and inflation fears tend to pressure risk assets.

- Competition advancements: New innovations from rival chains could siphon investor attention.

| Potential Catalyst | Impact on SOL | Likelihood |

|---|---|---|

| Regulatory clampdown | Moderate to high selling pressure | Medium |

| Network performance issues | Loss of user base, price volatility | Low to medium |

| Macro-economic turmoil | Broader crypto market drop | Medium to high |

| Competitor breakthroughs | Loss of market share, reduced demand | Medium |

Strategic Approaches to Mitigate Risks in Solana Investments

Investors navigating the volatile Solana market must adopt a multi-faceted risk management strategy to safeguard their portfolios. Diversification stands at the forefront, mitigating potential losses by spreading investments across various assets beyond SOL itself. Incorporating stablecoins, alternative cryptocurrencies, and even traditional assets can buffer sharp downturns, especially when Solana breaks critical support levels. Moreover, setting stop-loss orders at predetermined price points ensures automatic exit before losses exacerbate, blending discipline with market vigilance.

Equally important is staying informed through continuous market analysis and leveraging technical indicators. Employing tools like moving averages and Relative Strength Index (RSI) can provide early warnings of weakness, allowing preemptive repositioning. Additionally, investors should maintain liquidity buffers, ensuring they’re not forced to liquidate during low points. Below is a quick strategic checklist to help maintain a resilient stance:

- Regular portfolio reviews to adjust asset allocation

- Utilizing hedging instruments such as options or futures

- Avoiding emotional decisions based on short-term volatility

- Engaging with community updates for timely insights

| Risk | Strategy | Benefit |

|---|---|---|

| Price volatility | Stop-loss orders | Limits losses automatically |

| Market uncertainty | Diversification | Reduces exposure to a single asset |

| Liquidity crunch | Liquidity reserves | Prevents forced asset sales |

The Way Forward

As Solana navigates the turbulent waters following the loss of its crucial support at KEY, the coming weeks will be a true test of resilience for SOL. While the potential for a 30% drop casts a shadow of caution, it also opens the door for renewed strategies and opportunities. Investors and observers alike must stay vigilant, balancing optimism with realism in a landscape that is as dynamic as it is uncertain. In the story of Solana, this chapter may be a stumble — or the prelude to a comeback. Only time will tell.