Something moved over the previous 6 months.

A consortium of 9 European financial institutions has actually introduced prepare for a common stablecoin targeting a 2026 launch. JPMorgan broadened JPM Coin to sustain euro negotiations. Société Générale introduced EURCV with books held at BNY Mellon. Every one of this taken place within a six-month home window.

These are not pilot programs. They are manufacturing implementations backed by resources dedications and conformity structures. Establishments that invested years disregarding stablecoins as speculative tools are currently developing them straight right into core economic procedures.

For anybody running an exchange, this alters the discussion. The inquiry is no more whether stablecoins belong in standard financing. It is exactly how swiftly facilities adapts to what they have actually currently come to be.

What Ultimately Altered

2 obstacles dropped at the exact same time, and financial institutions scooted.

Initially, regulatory authorities created guidelines financial institutions currently recognize. MiCA in Europe and the Brilliant Act in the united state well-known structures that mirror existing needs for cash market funds and repayment cpus. Complete books kept in money and federal government safeties. Normal third-party attestations. Clear redemption civil liberties. Rigorous AML controls. As soon as stablecoins started to appear like controlled items financial institutions currently run, conformity quit being the traffic jam.

Second, the usage situation moved from trading to repayments.

In 2025 alone, USDT refined $156 billion in deals under $1,000, based upon on-chain information. These were not exchange transfers or institutional negotiations. They were retail repayments, compensations, and peer-to-peer deals occurring at range throughout boundaries and time areas.

When stablecoins began acting like cash individuals really make use of, instead of tools mixed in between trading places, financial institutions might no more neglect them.

Not All Stablecoins Coincide

The marketplace frequently deals with stablecoins as a solitary classification. That presumption is flawed.

USDC releases regular monthly attestations revealing books held nearly completely in money and temporary united state Treasuries with controlled custodians. USDT releases quarterly records with a more comprehensive book mix, consisting of Bitcoin and gold. This distinction in make-up is why S&P devalued USDT, pointing out reserve-related danger.

DAI adheres to a various version completely, making use of over-collateralization with crypto possessions secured wise agreements. This gets rid of dependence on financial institution safekeeping however presents procedure implementation danger.

Mathematical styles, such as Ethena’s USDe, keep their fix via by-products instead of straight books. These versions can create return in secure problems however have actually revealed susceptability throughout anxiety, briefly trading well listed below fix throughout market disturbances prior to recouping.

These differences are not scholastic. They establish whether a stablecoin can operate as negotiation facilities or stays mostly a trading tool. Financial institutions recognize this distinction, which is why their very own issuances comply with completely backed, controlled versions instead of mathematical experiments.

Why This Issues for Settlements and Beyond

Stablecoins have actually currently changed standard repayment imprison hallways where heritage systems stop working.

Employees sending out compensations from the Gulf to Asia pay under one percent in charges making use of USDT or USDC, compared to 4 to 7 percent via standard networks. Funds show up the exact same day as opposed to 3 to 5 company days later on. In nations with money controls or unsteady financial systems, locals hold stablecoins as artificial buck represent both financial savings and everyday deals. In numerous arising markets, many crypto purchase quantity is currently stablecoin‑denominated instead of driven by Bitcoin or Ethereum.

This is not speculative habits. It is useful cash running where financial facilities can not.

Establishments likewise make use of stablecoins as security in by-products markets, as negotiation possessions in between places, and progressively as return tools when coupled with Treasury direct exposure. They currently rest at the junction of repayments, financial, and resources markets in methods no solitary standard item reproduces.

What Exchanges Should Do

Exchanges establish which stablecoin versions make it through and which do not.

When S&P devalued USDT, exchanges reflected on danger direct exposure. When TUSD shed its fix in 2024 after book worries appeared, exchanges delisted it. These choices form the marketplace much more straight than regulative assistance or provider advertising.

I have actually viewed exchanges deal with this duty. The lure is to detail whatever and allow individuals choose. That technique falls short due to the fact that many individuals can not individually assess book high quality or procedure danger. Exchanges need to do that job.

The course ahead is uncomplicated however requiring. Assistance stablecoins that fulfill institutional requirements for books, openness, and law. Inform individuals on distinctions in between versions so danger accounts are clear. Deal with stablecoins as facilities, not speculative possessions.

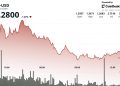

Stablecoin market capitalization currently goes beyond $300 billion, up from approximately $200 billion eighteen months earlier. Energetic individuals expanded greater than half year over year, and organizations report interaction with stablecoins coming close to 90 percent.

Financial institutions are taking note due to the fact that the facilities functions and the guidelines are clear. The inquiry dealing with exchanges is whether they will certainly sustain this facilities with the roughness it needs or treat it as one more speculative item classification.

At Phemex, our dedication is straightforward. Clear books over nontransparent support. Regulative clearness over administrative arbitrage. Individual education and learning over unattended growth. The financial institutions developing stablecoins currently recognize what issues. Exchanges require to use the exact same requirement.

The sector can await law to compel much better techniques, or it can execute them currently.

We select the last.

Please note

This post was added by a confirmed visitor professional, chosen by BeInCrypto’s content group for their tried and tested know-how. The viewpoints shared are only those of the writer and might not mirror the sights of BeInCrypto’s content personnel.